The Benefits of Automated Loan Originator License Tracking

Managing mortgage loan originator (MLO) licensing can be time-consuming, particularly if you’re navigating multiple licensing processes in numerous states.

License tracking and management have traditionally been done as a manual process. Individuals were tasked with following the license requirements at the federal and state level.

There are better ways. Take a look at how you can better manage MLO licensing with an automated license tracking and management system.

Challenges in the Loan Originator License Process

The S.A.F.E Mortgage Licensing Act of 2008 established minimum licensing standards and registration requirements for loan originators across the country. Additional requirements are handled on a state-by-state basis by the Nationwide Multistate Licensing System & Registry (NMLS).

In 2018, a provision under the SAFE Act was passed and made effective the following year. That provision, the Economic Growth, Regulatory Relief and Consumer Protection Act, is known today as the Temporary Authority to Operate. It allows for loan originators in the renewal process to work while they await final license approval.

The act streamlined processes for those seeking licenses in new states or moving from federal to state loan licenses.

It can be challenging to follow the requirements on both the state and federal levels. That task often falls to teams who track those requirements and their status using paper-based or manual processes. Manual tracking causes lapsed days when the process could be moved forward, reporting errors, the silo effect, and missed deadlines, which can mean approval delays for loan originators.

Manual reporting is also time-consuming, which means less time to focus on an organization’s long-term goals and provide data for strategic planning.

Benefits of Automated License Tracking and Management

Automated tracking of licensing eases the burden on loan originators and team members tasked with manual document management. The benefits in support of this level of business process automation are numerous.

A Centralized, Streamlined Approach

An automated process for license tracking and management allows for one central location of any MLO licensing information. Users can track real-time data and progress on upcoming deadlines and potential eligibility issues. This ensures that updates are completed without delay, potentially speeding up the license approval process.

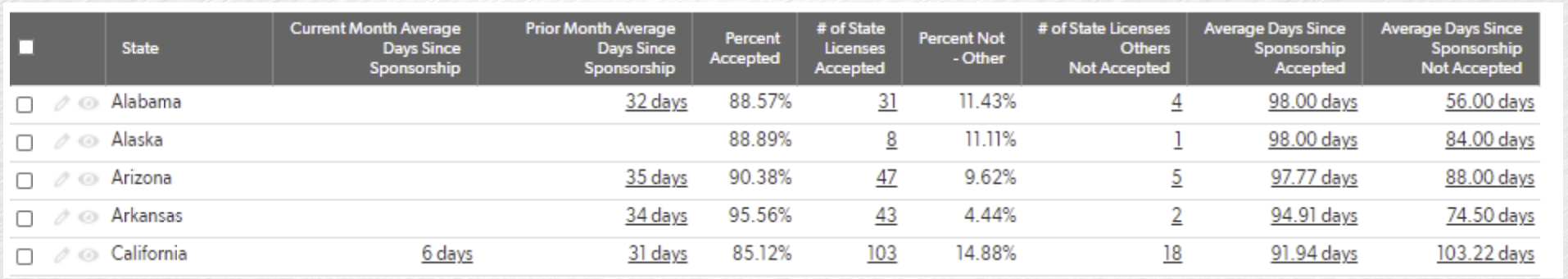

State-by-State Data

Automated processes eliminate the guesswork behind how licensing requirements differ state by state. Users can track tasks remaining by state or branch to easily see the status and any remaining to complete by deadlines.

The value of a feature like this cannot be overstated. Automation frees up staff for other priorities and offers loan originators peace of mind.

Greater Oversight

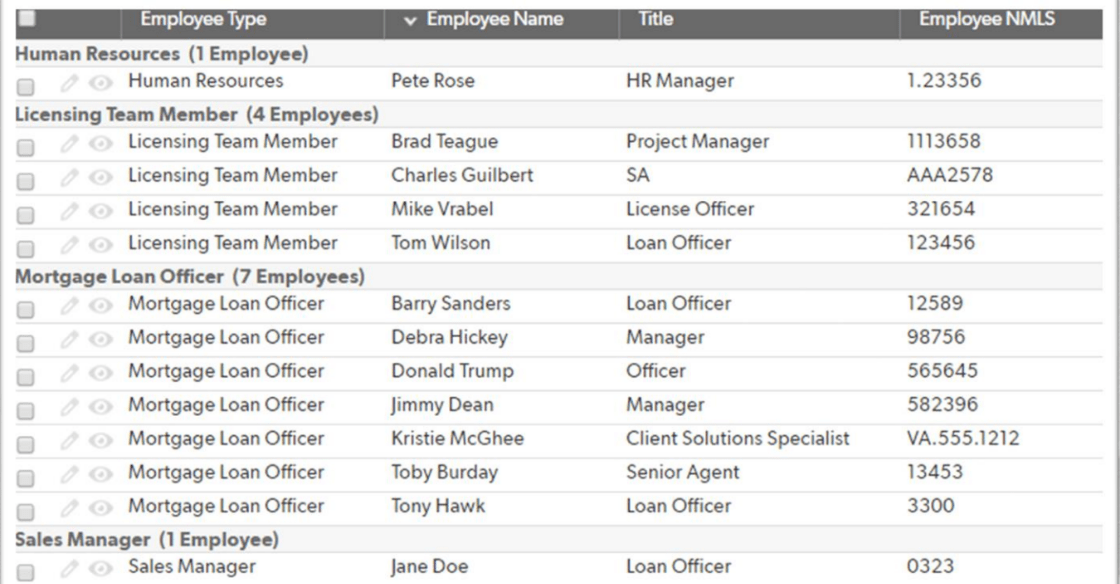

Organizations with several employees in various phases of meeting licensing requirements will appreciate the added oversight of an automated workflow. Available data will keep all team members on track with meeting requirements and follow-up by business leaders as necessary.

Businesses can even automate reminders of upcoming renewal dates and requirements.

Flexible Reporting on Trend Data

Customized solutions like loan origination software allow organizations to track relevant licensing data and address any inefficiencies on their teams. Data collected by the application can enable relevant information-gathering to spot trends that provide valuable information to a company’s strategic plan/or processes that need to be addressed.

The needs of organizations differ, after all. Solutions should be adaptable to meet unique needs to ensure your organization improves inefficiencies rapidly.

Who Would Benefit from Loan Originator License Tracking?

Loan origination management software can benefit financial institutions working with mortgage loans, mortgage brokers, and loan applications – particularly across state lines.

Automated tracking of loan originator status is an easy win. Any organization that wants to streamline its licensing processes is a good fit for automatic license tracking and management.

You’ve read about the benefits, but those benefits can mean significant results at your organization, including:

- Improved efficiency around license completion and approvals

- Data tracking for license approval or task completion

- Additional opportunities for collaboration among team members

Contact Trinity to Learn More About License Tracking and Management Software

Trinity’s license tracking and management software is an intuitive solution that takes the guesswork out of loan originator management. Take a seamless, streamlined approach to what is otherwise a cumbersome process and get your loan originators on track for success.